TRANS-URBAN-EU-CHINA

Transition towards urban sustainability through socially integrative cities in the EU and in China

Subsidies for urban development purposes

1. Purpose(s)

Public subsidies are defined as financial support by public authorities (supranational, national government, regional/provincial governments, municipalities), dedicated to public bodies, but also privates to (partially) finance and promote specific public objectives. Subsidies are inter alia used in transportation, housing, agriculture, mining, and other industries based on the assumption that preservation or expansion of these sectors is in the public interest (Encyclopaedia Britannica 2020; Farlex Financial Dictionary 2020).

Subsidies are implemented through different financial techniques by public institutions:

Direct payments

Governmental provision of goods or services at prices below the normal market price

Governmental purchase of goods or services at prices in excess of the market price

Tax concessions

There are numerous governmental policies that have additional subsidy effects, “such as regulatory statutes that soften the full force of competition, policies that require the purchase of goods from favoured producers or nations, and protective wage and price legislation” (Encyclopaedia Britannica 2020).

Subsidies can be divided into direct subsidies (e.g. direct payments for the refurbishment of the housing stock), which are easy to measure, and indirect subsidies (such as price ceilings, tariffs, and tax concessions), which are always more difficult to identify (Encyclopaedia Britannica 2020; Farlex Financial Dictionary 2020). Furthermore, they can be broad/flexible (e. g. renewal activities) or narrow/dedicated (e. g. soil recovery, green roofs). Mostly, subsidies address either the producer side or the consumer side or both. Production subsidies ensure producers are better off by direct payments to factors of production (e.g. government grants for the refurbishment of old houses) (Myers and Kent 2001). Consumption subsidies reduce the price of goods and services the consumer (e.g. rental costs within social housing programmes) (Myers 1998).

Key Words: Public funding, incentive, financing, public budget, direct subsidy, indirect subsidy, public authorities, production side, consumer side

2. Relevance and Impact

Subsidies, in terms of financial incentives to activate private stakeholders but also administrative authorities to implement measures of common or overall societal interest, can support socially integrative cities by financially supporting measures, that being not directly profitable but being crucial to ensure basic standards of quality of life for all (e. g. reducing environmental burdens or providing social amenities). Box 1 highlights some other facts, how subsidies can contribute to a socially integrative urban development.

This tool was selected through the analysis of good practice examples in Europe. In discussions with European actors during the project, subsidies, were regularly proven to be an appropriate approach to accelerate urban development, and renewal in particular. Nevertheless the tool is critically discussed regarding relieving private stakeholder from their tasks to contribute to general environmental or social standards. In general discussions, its potential also for Chinese context was mentioned.

Regardless of the type of subsidies, they are all able to alter the results created by free markets and extensive competition in a direction, which is seen in public interest by political decision makers. The effect of subsidies is to encourage the growth of specific features within a subsidised public sector (e.g. affordable housing, provision of public green space) that otherwise would not develop in the same way without funding (Encyclopaedia Britannica 2020). As a result, subsidies can alter the uses to which an economy puts its resources since they represent incentives for private owners to invest money for example in social or technical infrastructure or the housing stock. Experiences in urban renewal areas indicating spill-over effects around 1:7. This means public investments generates around sevenfold private investments.

3. Strenghts

Subsidies help to provide the socially optimal level of goods and services in the context of urban development; especially in those sectors, which are often serviced by private investments like housing, technical infrastructure or the creation of jobs. There are circumstances where the actual supply of a good or service falls below its demand, which leads to an unwanted shortage and a market failure (e.g. lack of affordable housing for low income households). One form of tackling this imbalance is to subsidise the good or service being under supplied, which lowers the cost for the producers to bring them to market. In theory, if the right level of subsidisation is provided, the market failure should be corrected (Chappelow 2020).

In addition, subsidies can lead to positive externalities. These are indirect benefits to a third party, achieved by economic activity triggered by public funding. A subsidy scheme for example, funding the refurbishment of a neighbourhood not only increases the standard of living of the inhabitants but can also lead to a rebirth of formerly vacant stores. This in turn provides income and job possibilities, which initially where not the main objective of the funding scheme. “Many subsidies are implemented to encourage activities that produce positive externalities that might not otherwise be provided (…). The counter part of this kind of subsidy is to tax activities that produce negative externalities” (Chappelow 2020). Box 2 presents additional facts on strengths of subsidies.

4. Weaknesses

Subsidies might prevent (financially) efficient outcomes and divert resources from more productive uses to less productive ones, encouraging the preservation of inefficient producers. The partly public funded erection of technical infrastructure for example could lead to increased costs and delays since there is less incentive to invest resources efficiently, compared to a solely privately financed undertaking. The test of the desirability of a subsidy therefore always contain a comparison of the public benefits with their costs in terms of higher prices, taxes, and inefficiency. And even if subsidies “are justified in terms of benefits to the general public, they result in either a higher level of general taxation or higher prices for consumer goods” (Encyclopaedia Britannica 2020). Additionally, subsidies raise the profits of those receiving beneficial treatment creating an incentive to lobby for its continuation even when the funding is not necessary anymore. In this case there is a risk that political and business interests obtain a mutual benefit at the expense of taxpayers or competitive firms (Chappelow 2020). Box 3 contains additional facts on challenges regarding the use of subsidies in the field of urban development.

5. Good practice examples

German National Framework of “urban development assistance programmes for sustainable urban development structures”

Since the 1970s, a dedicated funding programme to support urban renewal activities has been in existence, based on the German constitution, which allows the national state to support the federal states in challenges of urban development. It was initiated by the awareness of the need of physical refurbishment of existing neighbourhoods and socio-economic stabilisation to avoid deprived areas (Couch et al. 2011). The framework is embedded in national policies and the planning and building code. Based on yearly negotiations the national state and the federal states adopt a joint agreement on “Urban development assistance programmes for sustainable urban development structures”. In this agreement the funding objectives, principles and procedures are defined. The financial subsidies are provided from the national state, the individual federal state, and in addition from municipal budget (regularly one third by each entity). Based on this, the municipalities can apply for funding of several projects and activities, which need to follow the objectives and requirements of the programme and being strategically planned based on integrated urban development concepts (IUDP).

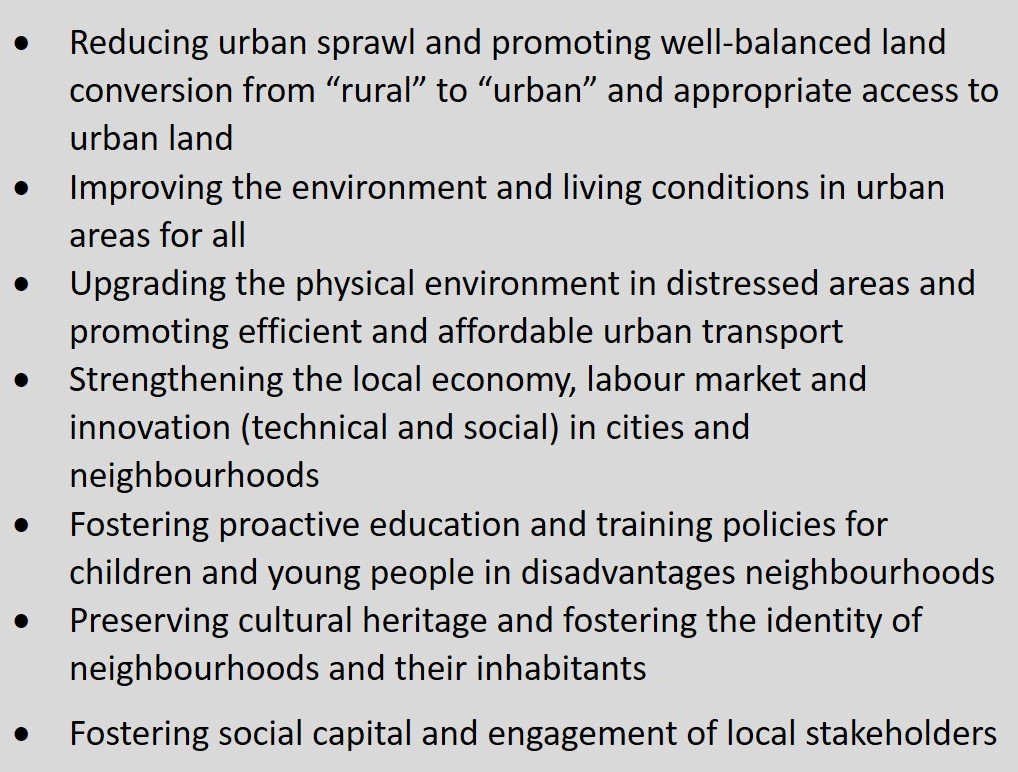

The main objective is to strengthen cities and towns as places for economy and life by resolving obstacles hindering this. Projects shall address the following objectives:

Strengthening inner cities and town centres regarding their urban functions, while at the same time considering the demands of provision of residential buildings and protection of historic buildings;

Creating sustainable urban structures in areas affected by a loss of significant urban functions (Figure 1); the principle indication of such functional losses is a permanent oversupply of structures such as vacant dwellings or derelict sites in inner cities; particularly industrial sites, former military sites, and railway sites are to be converted for appropriate re-use;

Urban development measures to eradicate social deprivation (Figure 2);

Ensuring provisioning functions of small towns in rural, peripheral areas (Figure 3);

Addressing environmental challenges, such as climate change and biodiversity loss.

Reflecting those main challenges of urban renewal, several programmes are defined, which are being adapted over the years. The initial and main programme has been the programme “Urban renewal and development measures” (IUDP). This was implemented from 1971 until 2012. Over the years, this has been accomplished by programmes addressing particular challenges as social integration, urban restructuring in shrinking cities, rehabilitation of historic cities, challenges of small-sized towns and green space development. While some programmes are focusing on physical challenges (abandonment and vacancies, retrofitting, infrastructure provision), others address social challenges explicitly. Since 1999, the programme “Socially integrative cities” has been supporting the stabilisation of neighbourhoods, which are physically, economically, and socially deprived. It aims at the improvement of the public space, the infrastructure and the living quality as a basis for intergenerational equity, vivid neighbourhoods and social cohesion to strengthen participation and integration. The programmes are regularly evaluated. National contact points (network activities, consultation, and good practice knowledge) support the implementation in order to ensure the best benefit for the municipalities. Besides the funding, legal regulations for the implementation based on the building and planning code need to be applied.

6. Further helpful study material

7. References

CHAPPELOW, J. (2020). Subsidy. www.investopedia.com/terms/s/subsidy.asp (retrieved 31.7.2020).

COUCH, C., SYKES, O. and BÖRSTINGHAUS, W. (2011). Thirty years of urban regeneration in Britain, Germany and France: The importance of context and path dependency. Progress in Planning, 75, 1-52.

ENCYCLOPAEDIA BRITANNICA. (2020). Subsidy. https://www.britannica.com/topic/subsidy (retrieved 31.7.2020).

FARLEX FINANCIAL DICTIONARY. (2020). Subsidy. https://financial-dictionary.thefreedictionary.com/subsidy (retrieved 31.7.2020).

MYERS, N. (1998). "Lifting the veil on perverse subsidies". Nature. 392 (6674): 327–328.

MYERS, N. and KENT, J. (2001). Perverse subsidies: how tax dollars can undercut the environment and the economy. Washington, DC: Island Press.

TRANS-URBAN-EU-CHINA. (2020). Land management instruments for socially integrative urban expansion and urban renewal in China and Europe. D 3.3 Report.

8. Author(s) of the article

Robin Gutting, Stefanie Rößler